Welcome to Just Two Things, which I try to publish three days a week. Some links may also appear on my blog from time to time. Links to the main articles are in cross-heads as well as the story. A reminder that if you don’t see Just Two Things in your inbox, it might have been routed to your spam filter. Comments are open. And—have a good weekend.

1: The humans that make AIs seem human

One of the dirty secrets of artificial intelligence and the Large Language Models that sit behind them is that behind the technology there is always a worker, often low paid, often in a remote global location, often recruited through a website, almost always working casually, on piece-rates.

Kate Crawford and Vladan Joler touched on this a couple of years ago, when they dissected the entire system of Amazon’s Alexa, which Peter Curry wrote about on Just Two Things. Now a long, long article in New York magazine—written in collaboration with The Verge—has gone into the world of the workers who train large language models.

All I’m going to do here is to skate across the surface of it, and if you’re interested in the way tech actually works (rather than the way that Silicon Valley says it works) it’s definitely worth some of your time. You get the flavour, though, early on:

Much of the public response to language models like OpenAI’s ChatGPT has focused on all the jobs they appear poised to automate. But behind even the most impressive AI system are people — huge numbers of people labeling data to train it and clarifying data when it gets confused.

The article starts in Kenya: the money’s better than the alternatives, but the work itself is confusing. You are basically a human teaching a device how a human would respond to something, but you don’t usually get a sense of the whole:

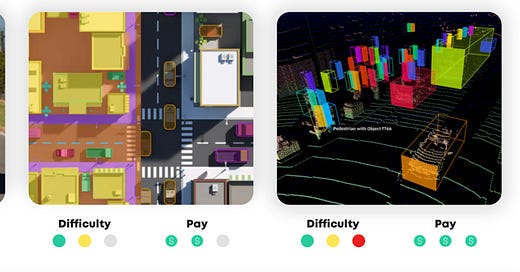

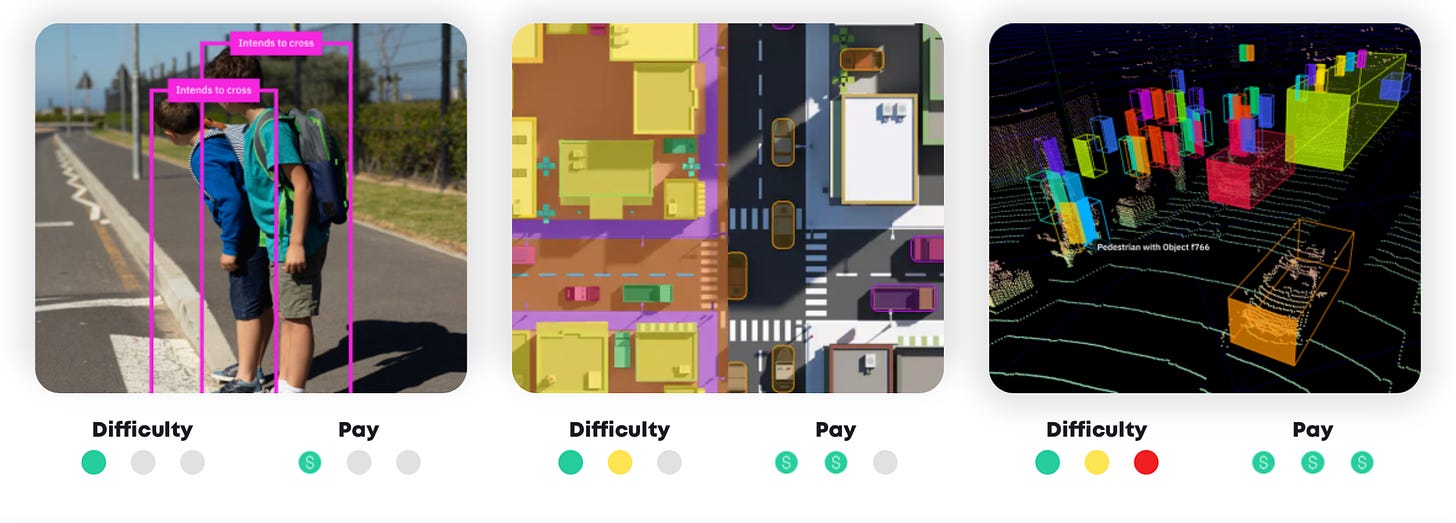

Labeling objects for self-driving cars was obvious, but what about categorizing whether snippets of distorted dialogue were spoken by a robot or a human? Uploading photos of yourself staring into a webcam with a blank expression, then with a grin, then wearing a motorcycle helmet? Each project was such a small component of some larger process.

(Images from from the Remotasks website, which recruits annotators)

Dzieza describes these as the inverse of David Graeber’s idea of ‘bullshit jobs’, by which Graeber meant work that had no meaning or purpose:

These AI jobs are their bizarro twin: work that people want to automate, and often think is already automated, yet still requires a human stand-in. The jobs have a purpose; it’s just that workers often have no idea what it is.

Labelling data is at the heart of Large Language Models, and the theory used to be that after a while you’d have enough labels on enough data, and the program would be able to work out the rest for itself. But it turns out, in effect, that there’s never enough data and it always needs labelling.

You collect as much labeled data as you can get as cheaply as possible to train your model, and if it works, at least in theory, you no longer need the annotators. But annotation is never really finished. Machine-learning systems are what researchers call “brittle,” prone to fail when encountering something that isn’t well represented in their training data. These failures, called “edge cases,” can have serious consequences.

Consequences like killing a woman wheeling a bicycle across a road, as an Uber self-driving car did in 2018. The program had been trained on pedestrians, and trained on cyclists, but didn’t recognise them in combination. There are always edge cases: using web-recruited annotators, and paying them by the task, is a way to make the labour pool bigger to get through more edge cases. Dzieza set out to talk to these annotators:

(W)hile many of them were training cutting-edge chatbots, just as many were doing the mundane manual labor required to keep AI running. There are people classifying the emotional content of TikTok videos, new variants of email spam, and the precise sexual provocativeness of online ads. Others are looking at credit-card transactions and figuring out what sort of purchase they relate to or checking e-commerce recommendations and deciding whether that shirt is really something you might like after buying that other shirt. Humans are correcting customer-service chatbots, listening to Alexa requests, and categorizing the emotions of people on video calls.

The work is almost all outsourced, and the workers who do it are required to sign strict non-disclosure forms. Most of Dzieza’s annotators requested anonymity for his article. It’s hard to know how many people are in this supply chain: the article quotes a Google research report that says “millions”, but that this could grow to “billions”. So nobody has a clue, in other words.

He also signs up for the work himself, in an entertaining section (he struggles). The instructions to the annotators have to be literal and deal with all options. The reason for that, of course, is that a Large Language Model has no context: it only has a label that it has learnt:

The act of simplifying reality for a machine results in a great deal of complexity for the human. Instruction writers must come up with rules that will get humans to categorize the world with perfect consistency. To do so, they often create categories no human would use. A human asked to tag all the shirts in a photo probably wouldn’t tag the reflection of a shirt in a mirror because they would know it is a reflection and not real. But to the AI, which has no understanding of the world, it’s all just pixels and the two are perfectly identical.

And so the challenge of an annotator ends up in a strange doppelganger world where a human has to think like a robot, so that a machine can pretend to be a human:

It’s a strange mental space to inhabit, doing your best to follow nonsensical but rigorous rules, like taking a standardized test while on hallucinogens. Annotators invariably end up confronted with confounding questions like, Is that a red shirt with white stripes or a white shirt with red stripes? Is a wicker bowl a “decorative bowl” if it’s full of apples? What color is leopard print?

Some of the most interesting material in the article is about how the annotators club together to manage the vagaries of the system, especially in places like Kenya. They also help people to learn which tasks to stay away from (the ones that are both poorly paid and complex are terrible) and share tips on doing the work effectively.

Some of the better paid work involves training chatbots, and that tends to be closer to home, in the United States. ‘Anna’ is paid to talk to ChatGPT for seven hours a day, and improve its responses. She enjoys the work:

She has discussed science-fiction novels, mathematical paradoxes, children’s riddles, and TV shows. Sometimes the bot’s responses make her laugh... Each time Anna prompts Sparrow, it delivers two responses and she picks the best one, thereby creating something called “human-feedback data.”

What’s going on here? It’s the same story: it’s the humans in the training loop that makes ChatGPT appear to be, well, human:

ChatGPT seems so human because it was trained by an AI that was mimicking humans who were rating an AI that was mimicking humans who were pretending to be a better version of an AI that was trained on human writing.

Some technologists think that the machines will get smart enough not to need this “reinforcement learning from human feedback” (RLHF). Reading the article, this doesn’t seem likely. It seems more likely that as the models become more complex and more sophisticated, the demands we make of them will increase, and so the edge cases will also become more complex. And so the demands made of the humans in the learning cycle will also become more complex.

2: Paying for clean water

I hadn’t really planned to write about the British water industry again, but the current crisis in Thames Water seems to be more than a local political difficulty. The accountant Richard Murphy has a post on his blog which looks beyond the detail of the failure of Thames Water to the wider issue of the “environmental bankruptcy” of the British water sector. The post is a summary of a longer report, called Cut The Crap, that was also published this week.

There are three problems going on here at the same time. The first is that rate of financial extraction from the British water industry by its commercial owners since privatisation has been eye-watering, and has involved loading the companies with debt.

The second is that the upward tick in interest rates over the last year or so has wrecked their balance sheets, because they can no longer afford to pay for this debt.

The third is that this vast shareholder freeloading has meant that the companies have spent only a fraction of what they should have spent on repairing and rebuilding the ageing infrastructure, with the result that raw sewage is being pumped routinely in Britain’s water systems.

So it’s worth spending a little bit of time on the two parts of this story—first, the financial shenanigans, and then how to invest in rebuilding the sewage infrastructure.

To analyse the first part of this, Murphy has created a set of accounts that integrates the accounts of all of the companies that provide both water and sewage services in the England. (It includes: Thames Water, Anglian Water, Northumbrian Water, Severn Trent, South West Water, Southern Water, United Utilities, Wessex Water and Yorkshire Water.) FN The water utilities in Wales and Scotland are both publicly owned. I know accounts aren’t everyone’s idea of a good time, but some of the headlines from the analysis are worth spelling out.

In the 20 years between 2003 and 2022, these companies made an operating profit of 38%, which is high. “Staggeringly high”, says Murphy. If you need a yardstick, a typical services business would make 15% operating profit, and you would expect utilities business to be a bit lower than that.

Interest costs ran at 20%—so more than half of those profits were paying for the cost of debt.

They paid some tax over that time, but less than you’d expect, and this left £24.8 billion in profits over 20 years. And all of that, plus a bit more, was paid out in dividends to shareholders—£26.7 billion.

So to summarise: really high profit margins from consumer bills (despite the water sector allegedly being regulated to prevent this happening); high interest payments (because debt levels are high); and every spare bit of profit, plus a bit more, over 20 years, funnelled to shareholders.

It’s worse just linking this back to the second point above, because I’m reminded of something that the economist James Meadway said when interest rates started to increase last year. I’m not sure if it was in an article or a tweet, but he basically argued that the UK’s economic system over the last decade or more—low wage, low investment, etc—had been completely dependent on low-to-zero interest rates.

But of course, the main reason that this really matters is because England’s watercourses are being polluted with raw sewage because the companies have failed to invest enough in infrastructure. Belatedly, they have come up with a plan to invest £10 billion over seven years to improve this (which they plan to charge to their consumers), but as Murphy says, this is, perhaps literally, a drop in the ocean. Other, larger figures, are also available:

The industry has offered to invest £10 billion over seven years, or £1.4 billion a year. The government has decided that £56 billion is required over 27 years, or just over £2 billion a year. The trouble is neither sum will come close to getting rid of the crap in England's water. The House of Lords looked at this issue based on independent analysis and concluded that the most likely estimate of the cost of getting rid of allthe pollution in our water was £260 billion.

That’s a lot of money, and the House of Lords report, and the independent analysis translated it into the size of household bills (it’s a lot). You can save some, basically depending on how much sewage you are willing to see discharged into environmentally sensitive rivers every year.

But before we get to that, it’s worth making a more important point. On pretty much any reasonable scale of sewage reduction, as Murphy points out, the water companies are “environmentally insolvent”:

The concept of environmental insolvency applies to any business that cannot adapt to make its business environmentally friendly – as climate change and ending pollution requires – and still make a profit. What it means is that its business model is bankrupt. That is where the English water industry is now.

This point is backed up by analysis in the report using “sustainable cost accounting”. There’s a wider point here—that in general the private sector would never be profitable if it had to pay for the environmental capital it gets through—but it’s rare to see such a clear cut example.

So how do you pay for this? You certainly don’t want to load it on consumers’ bills. The companies are carrying too much debt (quite a lot of which has, basically, financed dividends to shareholders) so they can’t take it on. Murphy has quite a clever suggestion here: a bond that works as an ISA (Individual Savings Account), so, tax-free with a fixed return, provided its held for a certain period of time. The numbers here look quite interesting.

The total value of the UK ISA holdings at the end of 2020-21 stood at more than £650 billion; in that financial year (the latest for which we have data) “amounts subscribed” totalled £72 billion.

Of course, no-one is going to trust the water companies with this, even if the government does find a way to re-capitalise them and socialise their losses. Murphy thinks that we should take them back into public ownership, and that would bring England back into line with the rest of Europe, and Scotland and Wales, come to that.

But there might be other ways to do this as well. In general, we need to find innovative ways to rebuild our infrastructure so it is climate ready. The savings market is already quite strongly incentivised by governments because savings and pensions are thought to be a good thing, even if this tends to benefit the better-off. At the moment, most of that ISA money ends up sitting in banks, which are most likely to use it on loans for property investment. Perhaps the question of how to rebuild our sewage infrastructure could be a pilot for those bigger and more valuable post-carbon infrastructure investments.

Thanks to Nick Wray for the link.

j2t#473

If you are enjoying Just Two Things, please do send it on to a friend or colleague.