27 June 2022. Divestment | Guns

Moving beyond black and white on climate divestment.// ‘Thoughts and Prayers’

Welcome to Just Two Things, which I try to publish daily, five days a week. Some links may also appear on my blog from time to time. Links to the main articles are in cross-heads as well as the story. Recent editions are archived and searchable on Wordpress. And a reminder that if you don’t see Just Two Things in your inbox, it might have been routed to your spam filter.

1: Moving beyond black and white on climate divestment

There was a long piece earlier this month in the Financial Times on the question of divestment, or disinvestment, from fossil fuel producing companies. It’s outside of the usual FT paywall. In truth, it rolled along familiar lines:

- divestment is bad because you lose the opportunity to engage with companies and influence their policies

- divestment is good because this is a moral issue and it sends a signal to a community outside of the business and financial community

- divestment is neither good nor bad, but these companies assets could easily become stranded assets so it’s less risky not to invest in them

- divestment is bad because it costs investors money (with added points if you represent a pension fund)

- divestment is good because the returns you get from divested funds are better than from non-divested funds.

If you think the last two are incompatible, that’s because it depends which stocks you’re talking about.

I’m not going to try to summarise the whole piece, just to pull out a few critical issues here. There’s no point in quoting someone who’s clearly using the ‘engagement’ argument as a way to get the returns they want while greenwashing their critics.

If you don’t believe in divestment, you’re likely to run an “outcomes” argument: has divestment actually reduced the amount of emissions going into the atmosphere? The article quotes Bill Gates as running this one in 2019, although one of the comments points out that Gates has since divested.

This is also the argument made by Blackrock, although their record on putting pressure on boards at AGMs, where they do ‘engage’—by voting for environmental proposals—is patchy at best, so this may just be cakeism. But for the record, here’s Blackrock’s Larry Fink:

The head of the world’s largest asset manager used his annual letter to argue that “divesting from entire sectors — or simply passing carbon-intensive assets from public markets to private markets — will not get the world to net zero.”

Maybe a fund like Engine No. 1, which does have clear environmental commitments, is better placed to make this case. It won three board seats on Exxon after pushing the business to adopt a lower carbon model:

In 2021 Exxon said it planned no “huge shifts in strategy” after losing the shareholder vote, but Chris James, founder of Engine No. 1, said this was not what happened...“They have gone from talking about net zero pledges as beauty contests to actually making net zero pledges,” he says. “Before the campaign, there wasn’t a business strategy where carbon was anything other than a byproduct of their oil and gas activities. Today managing carbon is one of the three pillars of their business.”

All the same, divestment campaigners clearly have momentum. On March 1 campaigners from divestment groups celebrated the fact that institutions represents $40trn under management had committed to divestment of fossil fuel stocks—up from $15trn a year earlier. Looking at the longer trend in the FT’s chart, which measured slow upward progress over a number of years, this represented a big jump.

When you listen to these campaigners, they clearly have a different model of change from, say, Blackrock. The article acknowledges that their model is more influenced by politics than economics:

Rather than take down any one corporation or raise the cost of capital for targeted companies, the idea is to stigmatise them, putting pressure on policymakers to introduce restrictive legislation, says Brett Fleishman, head of finance campaigning at 350.org. “We never thought a bunch of institutions divesting would hurt Exxon’s bottom line,” he says. “We wanted to make it popular for politicians to do the right thing by institutions making powerful statements by divesting from fossil fuels.”

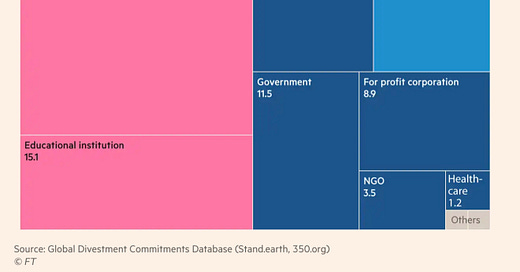

There’s also a moral dimension to this. The FT article has a useful chart showing the make up of organisations that have divested.

But there are good economic reasons to divest, which just comes down to investment risk:

When it comes to energy and natural resources, Oxford university’s stranded assets programme points out that stocks in these sectors are exposed to risks ranging from climate change to potential litigation, as well as the introduction of carbon pricing and greater competition as clean technologies become cheaper.

There’s a regional difference too. European organisations are more likely to back divestment on every decision where there is the potential to argue a divestment case—except for sugar, where the divestment movement hasn’t started yet. (But if I was a business with a lot of sugared foods and drinks in my portfolio I might be looking at this chart and thinking that it’s only a matter of time.)

It’s possible that the ‘engagement vs divestment’ argument is just a bit too binary. Campaigners and investors have also been looking at the bond market, and therefore the provision of corporate debt, as a way to put pressure on companies for change.

It turns out that this is surprisingly effective. Companies need to refresh their debt portfolio every year, and it is possible to attach pro-environmental conditions to bond issues.

Investors can deny a company funds by refusing to refinance or roll over corporate debt unless certain environmental or social conditions are met, such as accelerating the transition to renewable energy or achieving a workforce gender balance.

One of the interviewees in the article makes an analogy with a bank declining to make a loan to homeowner unless they also instal some insulation. Companies have responded by attaching environmental provisions to bonds before they get asked. It turns out that this makes the corporate bonds easier to place, since investors with sustainable finance portfolios will also participate.

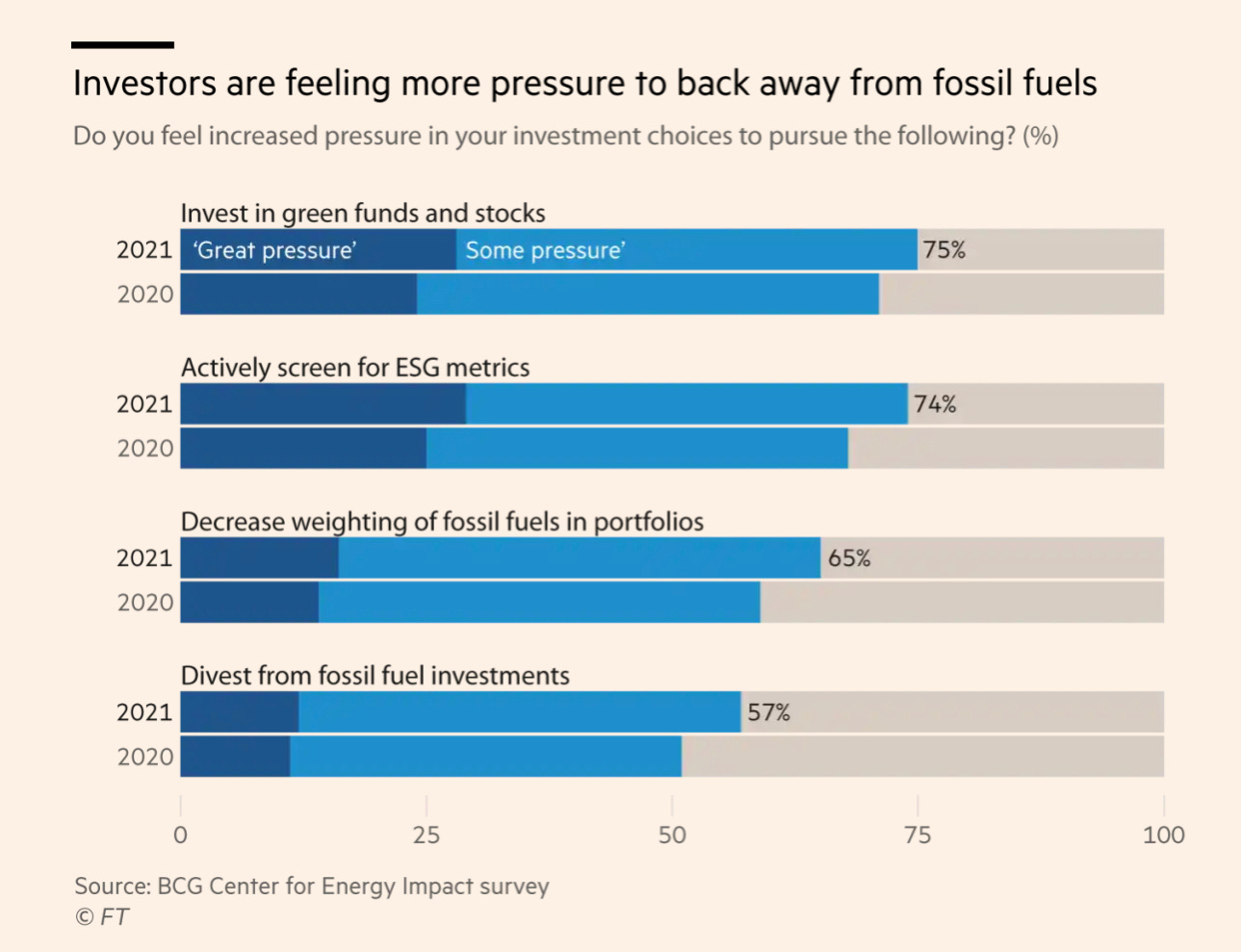

Investors are definitely under more pressure to take sustainability measure into account. A chart in the FT article shows that year or year expectations have increased on all of the measures that are used to assess these things. These numbers are well past the stage of ‘tipping points’.

2: ‘Thoughts and Prayers’

I know the whole discussion about the Supreme Court has already moved on from their controversial decision on handguns on Thursday (which I mentioned here last week) to an even more controversial decision on abortion on Friday. I wondered for a moment over the weekend if they were using the populist media strategy of “flooding the channels and continually shifting focus.”

I’m not going to spend time here on the errant history of gun use and gun law that Justice Alito drew on in constructing his narrative for the Supreme Court about “public carry” laws, although there is a good account of that here. Even writing this sentence makes me realise how strange the United States is when seen form this side of the Atlantic.

Anyway the channels were so flooded over the weekend that the news that President Biden had signed into law a bi-partisan bill that did increase the level of gun control in the US more or less got lost in the noise. To mark that, I’m sharing here a poem by Alissa Quart that Literary Hub published.

“Thoughts and Prayers”

by Alissa Quart

This poem is composed of the public statements around mourning over school shootings, from political leaders and websites, and is excerpted from Thoughts and Prayers, available from O/R Books.

Designed and executed. Us gun owners,

Our thoughts our team’s banner; our assault-

style thoughts and

#Prayfor

Praying impacted terrible

prayers on the scene

15 kids AR-15 pure evil

John 16:33 / horrific / my prayers / 1st responders

We continue to keep the victims

Kingdom of God. Columbine. Thoughts and prayers fireside basket.

The thoughts and prayers clear mount stamp

No child, teacher: There’s just no other way to describe it

Our hearts break for all the victims and families affected by today’s

terrible

satiation semantic civil religion common spiritual language shooting responders

The whole country stands

My heart is with Las Vegas we continue to keep the victims

My thoughts and prayers are with

$30 million in

donations. Thoughts

and prayers memes

Thoughts and Prayers: The Game,

Thoughts and Prayers tater

tots, A Thoughts and Prayers make-

up tutorial with invisible cosmetics.

Fantasy red blusher: “Blood of Our Children.”

Lifting up in prayer

all impacted by last night’s despicable

armed teachers

relatives affected

The thoughts and prayers stamp. The thoughts and prayers handcrafted

wood card.

The thoughts and prayers angel pin.

#Prayfor

“The science” of Thoughts and Prayers.

The ostensibly mixed

research about Thoughts

and Prayers.

My heart is with Parkland. My heart is

running down the hall

shooting

our prayers.

The Literary Hub article also includes two poems on the same theme by Rodrigo Toscano.

j2t#337

If you are enjoying Just Two Things, please do send it on to a friend or colleague.