27 January 2021. Capitalism | Glaciers

Reading Larry Fink’s non-‘woke’ annual letter to CEOs. Watching the glaciers disappear.

Welcome to Just Two Things, which I try to publish daily, five days a week. Some links may also appear on my blog from time to time. Links to the main articles are in cross-heads as well as the story. Recent editions are archived and searchable on Wordpress.

I’m away today, and so it’s possible that Friday’s edition won’t get out of the door.

1: Reading Larry Fink’s non-‘woke’ letter to CEOs

I’ve been looking for a way into the 2022 letter to CEOs by BlackRock Chief Executive Larry Fink. It’s the latest in a series which have done his profile—and BlackRock’s reputation—no end of good by promising that BlackRock is taking climate change seriously.

Whether that’s actually the case is still a bit of an open question, depending on what you mean by ‘seriously’.

And the question matters because BlackRock is, b some distance, the largest investment manager in the world, with $10 trillion in funds under management. So how it invests does influence the rest of the financial sector.

The letter is quite long, and is titled ‘The Power of Capitalism’, which is a pretty good indicator of tone. Someone in the public affairs department is earning their keep.

But it’s probably worth pulling out three things from the whole.

Purpose

The first is that he is one of the loudest voices promoting ‘stakeholder capitalism’. The alternative, ‘shareholder capitalism’, is now completely discredited, almost everywhere, except in the day-to-day actions of many of the CEOs and Chief Finance Officers in the corporate sector:

In today’s globally interconnected world, a company must create value for and be valued by its full range of stakeholders in order to deliver long-term value for its shareholders. It is through effective stakeholder capitalism that capital is efficiently allocated, companies achieve durable profitability, and value is created and sustained over the long-term. Make no mistake, the fair pursuit of profit is still what animates markets; and long-term profitability is the measure by which markets will ultimately determine your company’s success.

The important bit there is about ‘long-term’ rather than ‘short-term,’ and the rationale for this is that much of the funds under BlackRock’s control are held by pension funds, which need long-term returns. Somewhere in here he says that this isn’t a ‘woke’ sentiment—it’s just capitalism. This got some headlines when the letter came out, as it was no doubt intended to.

Related to this, he is clear that CEOs need to be clear about what the purpose of their business is. Again, my personal view is that this is a debate that’s over—quite apart from anything else, businesses without a clear statement of purpose find it very hard to recruit and retain decent staff—but there are still plenty of people in the financial community who disagree:

It’s never been more essential for CEOs to have a consistent voice, a clear purpose, a coherent strategy, and a long-term view. Your company’s purpose is its north star in this tumultuous environment. The stakeholders your company relies upon to deliver profits for shareholders need to hear directly from you... they do need to know where we stand on the societal issues intrinsic to our companies’ long-term success.

Sustainability

One of the reasons that Fink’s earlier letters to CEOs attracted attention was that he was early to the position that “climate risk is investment risk”. It also mattered that he was saying it from BlackRock, and he reiterates that here.

Sustainable investments have now reached $4 trillion.4 Actions and ambitions towards decarbonization have also increased. This is just the beginning – the tectonic shift towards sustainable investing is still accelerating. Whether it is capital being deployed into new ventures focused on energy innovation, or capital transferring from traditional indexes into more customized portfolios and products, we will see more money in motion.

Every company and every industry will be transformed by the transition to a net zero world. The question is, will you lead, or will you be led?

But it turns out that this doesn’t mean that BlackRock is actually, you know, going to disinvest from fossil fuel sectors. You might think that this is greenwashing, or cakeism1, and you might be right about this. But Fink doesn’t agree with you:

Divesting from entire sectors – or simply passing carbon-intensive assets from public markets to private markets – will not get the world to net zero. And BlackRock does not pursue divestment from oil and gas companies as a policy.

Well, this probably depends on the theory of change that you have about disinvestment. But even without divesting it’s possible for investors to indicate clearly that they plan to steadily reduce their exposure, which then sends out a clear set of market signals about declining long-term value, including the risk that fossil fuel assets will become stranded assets more quickly. And that increases the likelihood that we can afford to buy them up and manage them in the public good. (There’s more below on this.)

Staff

He talks about the ‘great resignation’ that’s going on in the US at the moment,

Companies expected workers to come to the office five days a week. Mental health was rarely discussed in the workplace. And wages for those on low and middle incomes barely grew. That world is gone.... Companies not adjusting to this new reality and responding to their workers do so at their own peril. Turnover drives up expenses, drives down productivity, and erodes culture and corporate memory. CEOs need to be asking themselves whether they are creating an environment that helps them compete for talent.

Obviously there’s a moral point there as well. But since the positioning here is all about good business practice being good for investment, that’s not something he’s going to say in writing, even if he believes it.

As Stowe Boyd says in an edition of his Work Futures newsletter today,

Other than saying CEOs need to get wise to the ‘new world of work’ he doesn’t really dig into the changes in the relationship between employers and employees.

And Boyd also picks out a line in the Letter for a bit more scrutiny:

I think that the biggest baloney in Fink's letter is in this line:

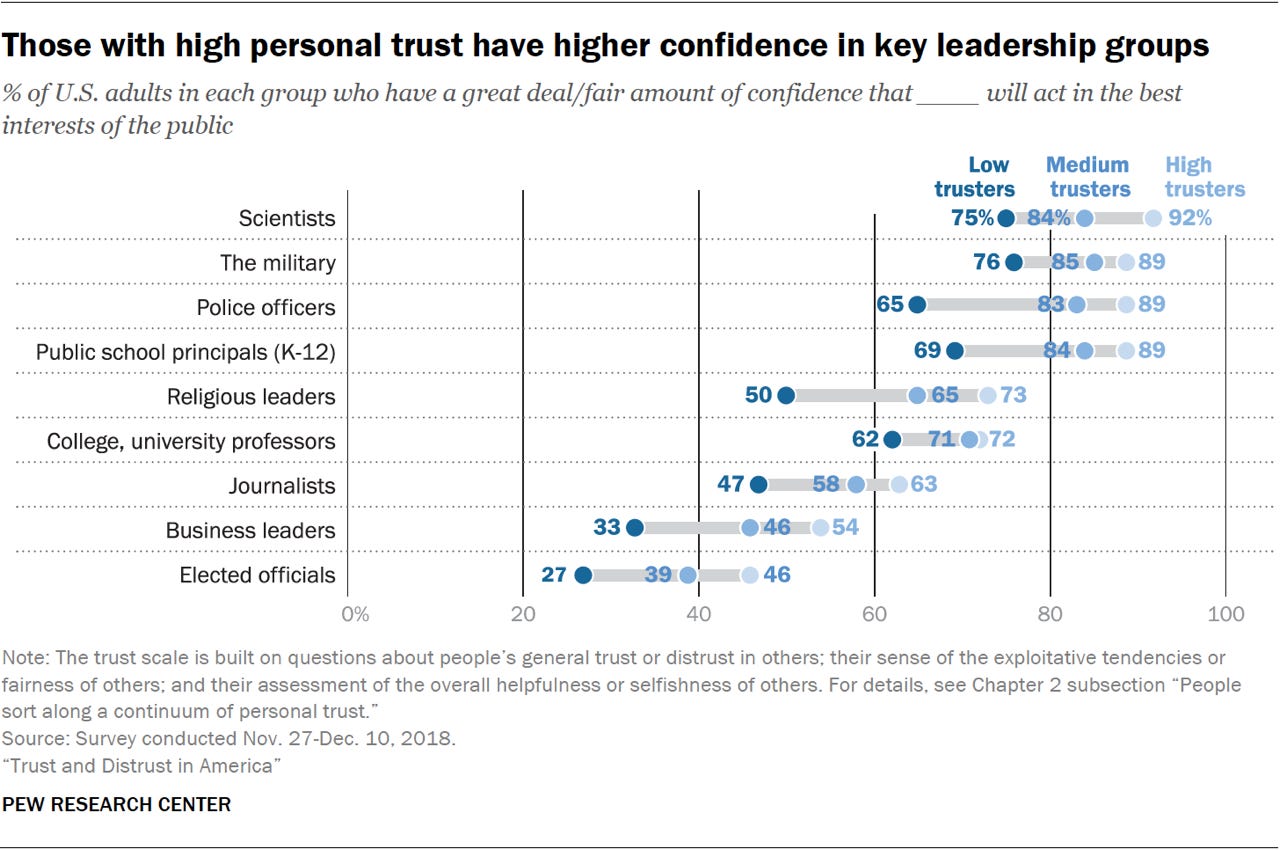

“Employees are increasingly looking to their employer as the most trusted, competent, and ethical source of information – more so than government, the media, and NGOs.”

There isn’t any proof of this. In fact, Boyd points to Pew Research, which actually has US data, albeit from a couple of years ago. The data says exactly the opposite.

The proportion of Americans who think that their employers “will act in the best interests of the public” is low. Employers are down there at the bottom, below journalists and just above “elected officials”.

There is one more point here. BlackRock’s customers are generally ahead of BlackRock on these issues. Pension funds and so on expect BlackRock to be doing due diligence on the investments they are making for them, especially on ESG issues (environment, social, governance). This is clear from a letter to clients that was issued by BlackRock at the same time. And when you look at it like that, Fink’s letter perhaps best thought of as high class marketing.

2: Watching the glaciers disappear

There was a note in Gregor Macdonald’s fortnightly (paid) newsletter this week that caught my eye:

The history of photography roughly spans the same period as the fossil fuel age. We are rich therefore in evidence of global warming’s progress, and the destruction it has already delivered.

And he linked to a series of images by Christian Aslund that documents the retreat of the glaciers at Svalbard. (If the name ‘Svalbard’ rings a bell, it might be because it’s the home to one of the largest seed banks in the world, now possibly at risk because the glaciers are retreating).

(Photos: Christian Aslund)

The full set of images can be found here.

j2t#252

If you are enjoying Just Two Things, please do send it on to a friend or colleague.

‘Cakeism’ is defined here: https://www.macmillandictionary.com/buzzword/entries/cakeism.html