24 August 2023. AI | Economics

What if the money in AI just isn’t there? // The political economy of how we got to where we are right now [#490]

Welcome to Just Two Things, which I try to publish three days a week. Some links may also appear on my blog from time to time. Links to the main articles are in cross-heads as well as the story. A reminder that if you don’t see Just Two Things in your inbox, it might have been routed to your spam filter. Comments are open.

1: What if the money in AI just isn’t there?

The technologist Gary Marcus has a strong question about the prospects for AI on his Substack. In fact, the question is in the headline. It goes like this:

What if Generative AI turned out to be a Dud?

By this he means, initially, a financial dud. I’ve written about this possibility here before, so I won’t spend too long on this part of the story, but since Gary Marcus knows more about this kind of thing than I do, and is better connected than I am, I will mention it:

But, to begin with, the revenue isn’t there yet, and might never come. The valuations anticipate trillion dollar markets, but the actual current revenues from generative AI are rumored to be in the hundreds of millions. Those revenues genuinely could grow by 1000x, but that’s mighty speculative. We shouldn’t simply assume it.

So far, the revenue has come from programmers, and that will likely continue. The second market he mentions, of writing text, seems less likely to generate huge revenues.

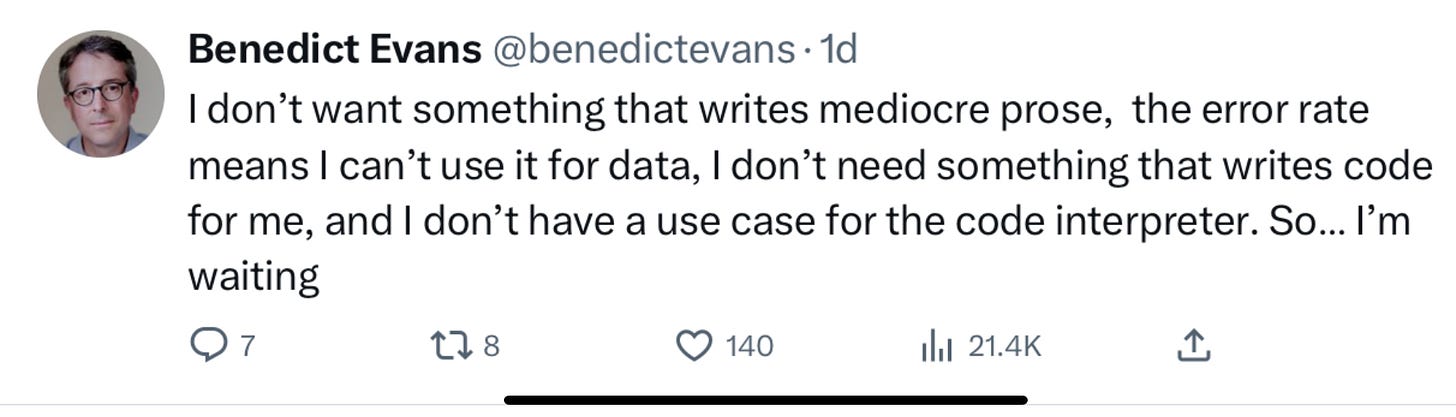

Marcus also quotes an influential source in support of his view, in the shape of the venture capitalist Benedict Evans, who reflected on Twitter on using versions of Chat GPT for the past six months.

As Marcus summarises here:

If Evans’ experience is a canary in a coal mine, the whole generative AI field, at least at current valuations, could come to a fairly swift end. Coders would continue to use it, and marketers who have to write a lot of copy to promote their products in order to increase search engine rankings would, too. But neither coding nor high-speed, mediocre quality copy-writing are remotely enough to maintain current valuation dreams.

There’s a bit of a discussion about things that might make a difference to revenues, such as search. But he’s more interested in the question of what if we are wrong about the money in the AI sector.

(W)hat has me worried right now is not just the possibility that the whole generative AI economy—still based more on promise than actual commercial use—could see a massive, gut-wrenching correction, but that we are building our entire global and national policy on the premise that generative AI will be world-changing in ways that may in hindsight turn out to have been unrealistic... what if the winner was nobody, at least not any time soon?

He suggests that the underlying issue here is that it’s in some people’s interests to conflate our actually existing generative AI with the prospect or possibility of AGI, or general purpose AI, “as smart and resourceful as humans if not more so”:

Everybody in industry would probably like you to believe that AGI is imminent. It stokes their narrative of inevitability, and it drives their stock prices and startup valuations.

But, looking at it from a technology point of view? Well, not so fast:

We have not one, but many, serious, unsolved problems at the core of generative AI — ranging from their tendency to confabulate (hallucinate) false information, to their inability to reliably interface with external tools like Wolfram Alpha, to the instability from month to month (which makes them poor candidates for engineering use in larger systems). And, reality check, we have no concrete reason, other than sheer technoptimism, for thinking that solutions to any of these problems is imminent.

He’s not the only person saying this. His article includes a photo of a recent Fortune story that says much the same thing. (I mistook this for an ad when I first scanned the article).

(Source: Fortune, via Gary Marcus)

Does this matter? Yes, for a couple of reasons. If winning the ‘war’ for AI is not a worthwhile public policy objective, because it’s not going to be transformative, we should spend more time from a policy perspective on ensuring that consumers get the protection they need from actually existing generative AI.

And secondly, Marcus also points out that some of the problems that are now widely known—bias, for example, or ‘hallucinations’, in which the AI autocompletes by making stuff up—have been known problems for years with solutions also promised for years. As he says:

It’s foolish to imagine that such challenging problems will all suddenly be solved.

And: if you can’t fix these problems, AI probably won’t ever be the trillion dollar a year business that its promoters talk about:

(I)f it probably isn’t going to make a trillion dollars a year, it probably isn’t going to have the impact people seem to be expecting. And if it isn’t going to have that impact, maybe we should not be building our world around the premise that it is.

2: The political economy of how we got to where we are right now

Suddenly my inbox seems to be filling with big picture synoptic political economy stories about what might be going on out there. I picked up on one version of that last week when I wrote about the polycrisis. I liked the charts but could have done with a bit more commitment. There’s a couple more to note.

The first is from the economist Peter Radford, in a numbered post on the World Economics Review blog. This is quite hard to summarise for Just Two Things, since it’s quite tightly written and Radford also insists that the order should not be taken to imply a causal story:

They are in no particular order, since imposing order suggests a level of understanding unjustified by experience.

But I’m going to have a go anyway. Here’s Point 1:

The spate of growth experienced in industrialized nations accelerated radically sometime around 1870.

That growth appears to be vertiginous, and over the course of the last 140 years we have got used to it. But (my phrase, not his), things that can’t go on for ever probably won’t as Stein’s Law put it. But:

Everything we enjoy, better health, longer lives, greater opportunities, broader cultural exposure, and better day-to-day security of existence, in sum our better wellbeing, are all due to the surge in economic growth since 1870.

(Girlfriends (Freundinnen) by Sigmar Polke, 1965/66, via Tate, London)

But despite this growth being foundational, we still don’t have a very good story about how and why this happened. We also believe that this surge of growth has enabled us to escape the Malthusian trap in which population growth outpaces food production—and food shortages than curtails population growth.

One of the effects of this has been political:

We have created what we call democracies that include even the least privileged people — albeit haltingly — in the political decision making framework It was the degrees of freedom created by rapid economic growth that gave traditional elites — aristocratic, monarchic, religious, military, and landed — both an incentive and the space to share their privileges. Including the masses became both necessary, (as motivation), and wise, (as reward), in order to maintain elite benefits from growth.

He suggests that these various forces compressed time: “Eras that used to be timed in terms of centuries are now timed in decades.” Maybe, maybe not: I think it depends what you’re looking at, as Stewart Brand’s pace layers model reminds us. But he suggests that as a result,

the traditional cohesion of memory and experience has been overturned. We live with multiple histories and cultures competing for pre-eminence within each society all at once. This complicates politics — inter-generational conflicts muddle class conflicts.

It’s hard not to read some of Radford’s account here as a causal story, despite his advising us not to. Because the consequences of growth and the relative acceleration of these social and cultural narratives led to extreme distributional conflict, which generated ideological innovation, not all of it good. Fascism, communism, and forms of liberalism all played out in the middle of this part of the story.

And some time in the 1980s, around the same time as the growth story started to go wrong, the distributional conflict became less extreme. (Again, I’m trying to respect Radford’s suggestion that we don’t understand the causality). But things did start to go wrong:

The pace of innovation slowed which, in turn, slowed the pace of productivity improvement; the degrees of freedom for elite power sharing were thus reduced; tension mounted; pre-modern social structures began to re-emerge; distribution consequently began to revert to traditional arrangements; ideological conflicts re-arose; politics soured. The re-emergence of radical inequality — both vertical and horizontal (per Elizabeth Anderson) — undermined, if not destroyed, democracy. The march towards utopia (per DeLong) — despite our evident historic prosperity — stalled.

The result of all of this, says Radford, is that “we went back in time”. What he means by this is that “society congealed into more noticeable classes”, but that these classes were “an upper echelon business class” and its technocratic helpers, who have captured wealth, political influence, and the entire public discourse.

Radford’s not particularly happy about this. World Economics Reviewis one of those places where critics of the system hang out:

As this class syphoned off wealth from everyone else — as elites have usually done in the past — it ignored the ongoing structural transformation of the economy. It benefitted from the globalization of capital and so could maintain its own upward trajectory, and, at the same time, overlook the long term consequences of climate change, demographic mix and aging, and the implications of the transition into a service rather than industrial economy.

He runs out of steam around here. Point 14 is a bit of a diatribe—he uses the phrase “intellectual bankruptcy” somewhere—and he doesn’t have answers, at least not yet. Some of his description reminded me of Peter Turchin’s work on secular cycles and elite capture.

(Image: Chris Devers/flickr, ‘Banksy in Boston’. CC BY-NC-ND 2.0)

As it happens, some questions about the reshaping of the global economy were on the mind of the economist Branko Milanovich at around the same time, although he had less of a historical span. He offered ‘Eleven Theses on Globalisation’ on his Substack.

In brief, and I’m paraphrasing radically here, he suggests that many of the issues we’re seeing are down to the way in which globalisation has re-balanced the world economy back towards Asia after a couple of centuries when Europe and the US unbalanced it:

China and India cannot be pushed back to their 19th century positions. They are steadily changing the balance of power bringing the ratio between Europe/America and Asia back to the one that existed before the Great Divergence.

This has made people revisit their view of the open trade that underpins globalisation, and has sharpened geopolitical tensions. A big downside of globalisation has been its effect on climate change:

The several-fold increase in global GDP in the past 30 years, has also increased CO2 emission by approximately the same ratio. This has made the achievement of climate change targets more difficult, and has opened up another area of contention: the targets can be more readily achieved if the West were to grow more slowly and the rich people everywhere taxed more heavily.

He says immediately in the next line that these last two are both “politically unacceptable propositions”. I think I might maintain a more open mind on this, especially the second one, rather than closing them down straightaway. I mean: politically unacceptable to whom?

And globalisation, he observes, “has also proceeded by financialisation of the economy”. I’ve written about the downsides of this here from time to time. I was surprised that Milanovich didn’t make more of this. From where I’m sitting, this is a feature of the current system, like the climate change impact, which says that the present system has reached its limits.

He’s not particularly strong on what is to be done either:

We need... to accept that for the world it is better if there is an approximate equality of wealth and power between different nations and cultures, as well within individual nations, and to reduce carbon emission by a combination of high taxes on emission-intensive goods and subsidies to their alternatives.

But as Radford points out: part of our current problem is that those elites just aren’t very keen on equality, even if it’s just “approximate equality”.

j2t#490

If you are enjoying Just Two Things, please do send it on to a friend or colleague.