Welcome to Just Two Things, which I plan to write daily, five days a week, if I can manage it. Some links may also appear on my blog from time to time. Replies should come to me by email.

#1: The auto transition—peak combustion engine

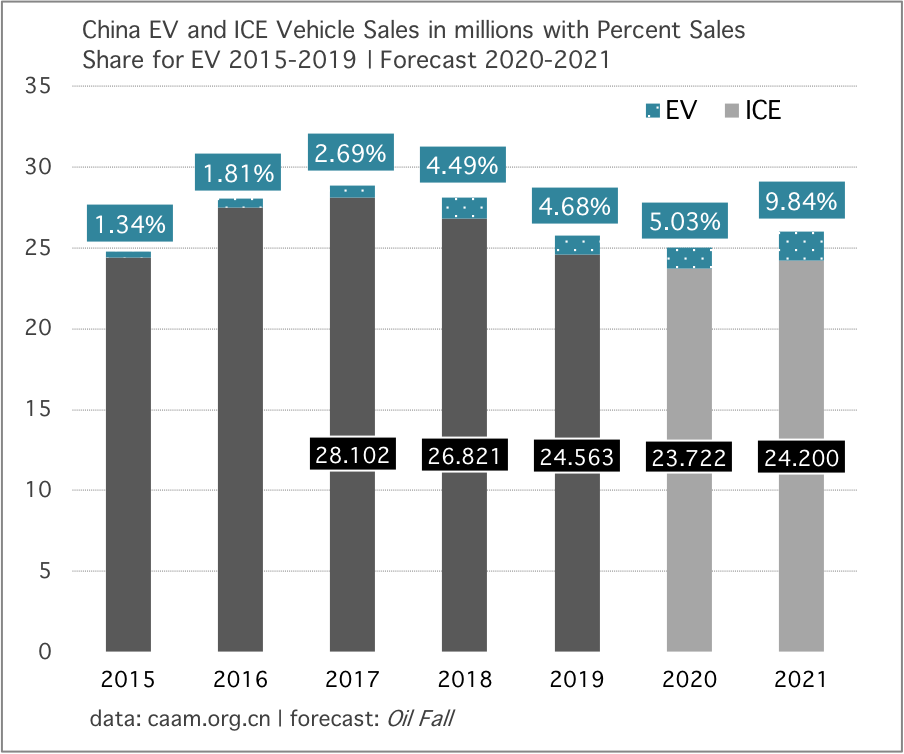

I subscribe to the energy analyst Gregor MacDonald’s newsletter, The Gregor Letter, because he is a shrewd analyst of the energy transition. The last edition of 2020 included some striking data from the Chinese car market that suggests that China has reached what might be called “peak combustion engine”. In other words, new demand in the car market is being picked up by electric vehicles (EVs), and demand is accelerating.

His summary:

China killed the future of the combustion engine and this was known two years ago. It would be a shame, and not very impressive, if anyone in a policy-making role were to still not understand this truth. Yes, ICE vehicles will be manufactured for years to come. But in Europe and China, the market for them has now entered long-term decline. And not too long from now, all the associated infrastructure required to produce and maintain ICE vehicles will suffer the loss of network effects, as their total share steadily declines. As usual, the American incumbent automakers were the last to figure it out, and take action.

Although the newsletter is subscription only, Gregor has a twitter thread that unfolds the argument.

#2. The three lies of finance

I listened to Mark Carney’s Reith Lectures over the break, in which he describes the triple crisis of our times as being related to credit, COVID, and climate change. Carney stepped down as Governor of the Bank of England earlier this year after a lifetime in finance. Like most non-Marxist critics of actually existing capitalism, he starts from Adam Smith’s Theory of Moral Sentiments. He then goes on to critique the market-led obsession of our recent political economy as having created a gap between ‘value’ and ‘values’. Both Covid and climate change require us as societies to confront that gap, he argues. It’s a good argument well-made, and a sign for me of where intelligent elite opinion is heading in the face of capitalism’s current failings.

The lectures are here, and there are downloadable pdfs available if you’d rather read them than listen.

One bit I liked in his lecture on Credit was his list of the ‘three lies of finance’. There’s more on each of these but here’s the top line of each lie:

1. This time is different

2. Markets are efficient

3. Markets are moral.

He ends up calling for bankers to remember their social purpose, and that would be a good thing, but nowhere in the lecture (or in the questions) did he address the vastly distorting effects of low margin high frequency trading on the values, and the broader impact, of the financial system.