Welcome to Just Two Things, which I try to write daily, five days a week. Some links may also appear on my blog from time to time. Links to the main articles are in cross-heads as well as the story.

#1: Writing about sickness

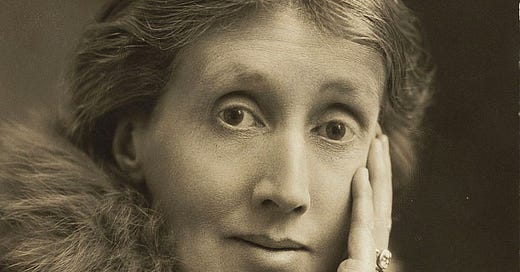

(Virginia Woolf in 1927. Via Wikipedia)

We’ve just ticked past the 80th anniversary of the death of the British writer Virginia Woolf, and The Conversation has published a series of articles to mark the anniversary. Without being too instrumental about it, the one that caught my eye was about the way that illness and sickness infused her writing, notably in Mrs Dalloway, written in 1925. I’m still wondering about how our experience of our own pandemic will be filtered into our culture.

Jess Cotton, who wrote the article, teaches English at Cardiff University, and used Mrs Dalloway as a way in to her teaching during lockdown:

Mrs Dalloway provided an entry point to make sense of the business of studying and thinking while a new national emergency unfolded around us. The protagonist of Mrs Dalloway is a survivor of the Spanish flu of 1919 and the sense of life that permeates the text emerges from her experience of rediscovering the pleasures of life.

Even the opening line—the apparently mundane “Mrs Dalloway said she would buy the flowers herself”—is about the experience of sickness, of being confined indoors, ot taking the opportunity to go outside. Obviously 1920s Britain was dealing with the double grief of war and of the Spanish flu, but one of these was pushed to the edges:

Woolf recognises how easily it is to cast characters to the sidelines of life. This is, after all, how national fictions work, by making space for protagonists at the expense of those who are pushed further out of view. In the case of post-war Britain, space was made for the glory of war but not for the sadness of the Spanish flu.

Reading her article, Cotton seems to create a tension between the individual experience of death and the public experience: memory and mourning were put to work in the service of Empire, at least in public. But one of the things that modernism does is to take us into ourselves, and our inner worlds—a different form of knowing:

Woolf saw that a subjective perspective was required to make sense of how death continues to inflect the mood of a generation. Mourning, as Sigmund Freud also realised at a similar point, is ongoing, illusory work. What is remarkable about her writing is that Woolf draws our attention to how death pushes us beyond what we can know.

The other articles on Woolf in The Conversation are about music and cinema.

I’d come to the conclusion that there was nothing to be added to the story of the stuck boat in the canal, especially now that it is no longer stuck; and indeed, that this might be a virtue. But Matt Stoller’s newsletter BIG—which looks at monopoly and monopolisation—has persuaded me that I am wrong about this.

His newsletter this week has a fascinating analysis of the way in which global supply chains have pursued efficiency over resilience, and have become vastly concentrated at the same time.

The rate at which the global shipping industry has concentrated is remarkable. In 2000 the ten biggest shipping companies has a 12% market share. By 2019, this had increased to 82%. This understates the level of concentration, since there are alliances between the main shipowners. Over the same period, the size of cargo boats has increased by a factor of four. This is not a good way to run the world’s trade:

We’ve already seen significant problems from big shipping lines helping to transmit financial shocks into trade shocks, such as when Korean shipper Hanjin went under and stranded $14 billion of cargo on the ocean while in bankruptcy. It’s also much harder for small producers and retailers to get shipping space, because large shippers want to deal with large clients. And fewer ports can handle these mega-ships, so such ships induce geographical inequality. Increasingly, we’re not moving ships between cities, we’re moving cities to where the small number of giant shipping lines find it efficient to ship.

Stoller points the finger at a particular type of globalisation—of the kind advocated by Thomas Friedman in his early 2000s book The Lexus and the Olive Tree, of a kind of “high efficiency” just in time global trade system. Obviously Friedman didn’t cause this globalisation, but whenever there’s a set of ideas that favour the interests of finance, someone is going to get rich and famous by popularising them.

And it turns out that there are odd shortages in all sorts of places in different supply chains:

Semiconductors and Suez are the most prominent supply chain disruptors, but there are shortages wherever you look. We are still in shortage of hundreds of pharmaceutical products, including salt water in a bag. Bedding makers are having trouble getting access to foam, ammunition makers can’t get enough metal and primers, RVs are in short supply, as are fridges, air conditioners and furniture, and there’s still a basic lack of shipping containers.

The list in his piece is longer: building ties, farm machinery parts, and so on. But in short, this globalised system effectively has chokepoints and shortages built into it. Stoller advocates three changes, all of which will take time:

First, we need to restore anti-monopoly rules, such as antitrust, to prevent the consolidation of production and distribution in the first place. Second, we should re-impose friction, like tariffs, in global trading so that we relocalize production. Trade is generally a good thing, but every country or geographic bloc should be able to provide itself with the essentials, in case there are disruptions. Third, we should rapidly restructure the way that firms finance themselves, so that they have less debt.

Apart from the anti-monopoly one, these don’t seem quite right to me. Without going down the tariffs route, which creates adverse geopolitical effects, some of the artificial advantages enjoyed by international trade could be suppressed. Debt is not a good thing, but the financialisation of non-financial businesses isn’t driven only by debt. In general though, on the upside, policy-makers and businesses are now moving in the right direction.

j2t#069

If you are enjoying Just Two Things, please do send it on to a friend or colleague.