16 May 2022. Fashion | Bitcoin

We need slow fashion. // The function of Bitcoin is to market the crypto sector.

Welcome to Just Two Things, which I try to publish daily, five days a week. Some links may also appear on my blog from time to time. Links to the main articles are in cross-heads as well as the story. Recent editions are archived and searchable on Wordpress.

And just a reminder that I have opened the comments.

1: We need slow fashion

Fashion, especially fast fashion, has become a planetary curse in the last two decades. Specifically, over the past 15 years, global clothes production has doubled, while the time we wear the clothes we buy has fallen by 40%. The Conversation has helpfully pulled together in one place different recent pieces on the subject.

The industry accounts for 10% of global carbon emissions, but that’s only part of the story. Some of the local and regional effects are at least as bad, according to Mark Sumner of Leeds University:

He reported that “it takes one-and-a-half Olympic swimming pools of water to grow one tonne of cotton”, and this is often in regions plagued by drought where farmers may only have “10 to 20 litres of water a day for washing, cleaning and cooking”.

Actually, it’s worse than that:

Adding colour to that fabric uses yet more fresh water, which is often washed into waterways untreated afterwards – harmful chemicals and tiny fibres included. “In Cambodia, for example, where clothing comprises 88% of industrial manufacturing, the fashion industry is responsible for 60% of water pollution,” Sumner says.

The climate impact of each T-shirt is the equivalent of driving 14km (9 miles) in a standard sized car.

And although defenders of all of this sometimes points to the number of clothes manufacturing jobs in low income countries in Asia. But as Samantha Sharpe, Monique Retamal and Taylor Brydges of the University of Technology Sydney observe, ‘ultra-fast fashion’ is

also leaning on some of the most exploited workers worldwide, in countries such as Myanmar, Cambodia, Bangladesh and Vietnam where garment manufacturing presents an extreme risk of modern slavery.

So what is to be done? We need to buy fewer clothes—in fact we need to cut the number of clothes we buy by 75%. (The Jump, which I wrote about in March, thinks we should buy only three new items of clothing a year).

(‘Shirts’, by ‘The Justified Sinner/flickr. CC BY-NC-SA 2.0)

That sounds like a challenge, but there are ways of learning to live with less. Amber Woodhead-Martin has done both the

The Great Fashion Fast, (pun intentional, I think), where you choose ten main items and wear them for a month (you get a pass on underwear and sportswear), and also Labour Behind the Label’s Six Items Challenge, where you wear six main items for six weeks.

Her tips:

picking “a few matching colours so that everything goes together”, “pick different items that can make lots of different outfits” and choosing “versatile items that can be layered and worn in different ways”, like a jumper that can also be worn as a cardigan.

Sharpe, Retamal and Brydges propose a ‘slow fashion’ movement, prioritising classic styles and quality clothing, buying secondhand, and being willing to mend things. In this, they’re following in the footsteps of Kate Fletcher, who borrowed the idea from the ‘slow food’ movement in an article in The Ecologist in 2007.

There’s also some evidence that shopping second-hand might be associated with stylishness, according to Australian researchers Louise and Martin Grimmer:

“In our study, we found the higher people rate on style-consciousness” – essentially, how passionate they were about expressing themselves through their clothes and developing a personal style – “the more likely they are to shop second hand. In fact, style-consciousness was a bigger predictor of second-hand shopping than being frugal or ecologically-conscious.”

Obviously, this all sounds great in theory, and necessary. But although there’s some signs that fashion retailers have adjusted their behaviour fractionally in response to social concerns, they’re locked in to particular business models that require over-consumption. As with pretty much everything else involved in improving climate and ecological outcomes, or ensuring social justice, and on the necessary timescales, it’s going to take some from of market intervention.

2: The function of Bitcoin is to market the crypto sector.

Noah Smith has tried to work out what kind of asset Bitcoin is in a recent edition of his newsletter. I’m not sure how geeky this is, but he thinks there are four main theories floating around:

Theory 1: Bitcoin as the future of money

This was the original theory of Bitcoin—it was supposed to replace fiat currencies such as the dollar, the Euro, or sterling. And the idea that produces the biggest potential gains for investors is the idea that “Bitcoin is not now money, but will eventually be money”.

Because—especially given that there’s a limit to how many bitcoins there are—the value of bitcoins will increase as it becomes money. Smith describes this as the “Bitcoin maximalist” position. But:

The problem is that so far, there’s very little sign of the Bitcoin maximalist case coming true... Bitcoin is a very volatile asset, making it bad for making payments — between the time you get your paycheck and the time you go to buy groceries, the amount of groceries you can buy will probably vary wildly.

And El Salvador, which made bitcoin legal tender in 2021, has found this out the hard way.

(Bitcoin image by Jernej Furman/flickr. CC BY 2.0)

Theory 2: Bitcoin as a worthless fad

It’s possible that Bitcoin will end up being worthless, perhaps helped along the way by regulatory clampdown, since regulators can get irritated by financial instruments that are also used for cybercrime and evading sanctions and so on. But in this case, precisely because it is possible to use it in this way, it would likely maintain some of its value.

Theory 3: Bitcoin as “digital gold”

Gold has a use value (e.g. it’s used in mobile phones) but its exchange value/investment value is often much higher:

Gold’s price sort of appears to move on its own, moved partly by commodity prices but partly simply by people’s belief in the story of a return to a world where gold is money. Bitcoin might conceivably be like that.

But then again, it might not be. Gold is often used by investors as a hedge against economic disaster, Bitcoin not so much:

Analysts have noted that Bitcoin is increasingly correlated with technology stocks — the correlation with the NASDAQ recently reached 0.82 (for those who don’t know, correlations max out at 1). Bitcoin has fallen substantially during the recent inflation... And as recession fears have increasingly weighed on the economy, it has fallen even more.

Theory 4: Bitcoin as a tech stock

So maybe bitcoin is just a version of a tech stock—that’s a pretty close correlation, after all. And there may be good reasons for that. A lot of bitcoin buyers work in the tech sector, and they get paid in part in stock, so when tech stock prices fall, Bitcoin prices fall. There’s a ‘but’ here as well”

But if Bitcoin is a tech stock, then we have to think about if and when the technology becomes obsolete... Bitcoin is enormously expensive to transact in, due to the vast electricity usage of the proof-of-work algorithm on which it relies. Also, you can’t really do much with Bitcoin besides trade it back and forth. Whereas the Ethereum and Solana blockchains are optimized for creating smart contracts and decentralized autonomous organizations (DAOs), Bitcoin just mostly sits there like a rock.

Solana already uses a lower energy ‘proof of stake’ algorithm, and Ethereum is considering this switch. Bitcoin seems stuck with its high energy cost solution.

So where does this leave Bitcoin? Smith concludes that it may be none of these things—instead Bitcoin works as a kind of marketing function for crypto, in all of its different functions.

(T)he purpose of all the massive apparatus of Bitcoin-related guff and mythology and gobbledegook is to onboard people into the crypto world... This theory of Bitcoin as the “gateway drug” of the crypto-verse sort of ties all of the previous theories together.

In this composite version, the idea of Bitcoin as future money, or Bitcoin as digital gold, get people interested. They attract attention. People coming into the crypto sector buy some Bitcoin... which means that it ends up being one of the currencies that gets used across the crypto sector generally. Which means that it continues to have exchange value, and is less likely to slide into irrelevance.

But this doesn’t make it sound as if it is the future of money—or that it has a huge speculative upside.

Update

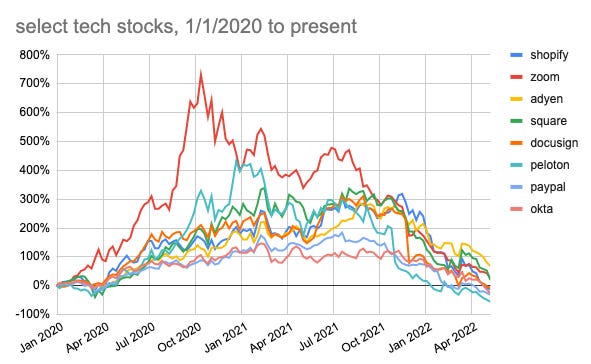

I wrote last week about Netflix’ slowing market, and the possibility that this was a sign that we were moving to the mature phase of the 50-year ICT ‘surge’. In a piece in his newsletter, John Luttig takes a two-year view of the tech sector, going back to early 2020. He concludes that tech investors were fooled by the mini-tech boom during the pandemic, and that what we’re seeing now is ‘a reversion to the mean’:

There were three potential scenarios for the future of technological growth:

- Exponential: Pandemic era acceleration represented the new baseline growth rate. Instead of growing 10% annually, e-commerce and other categories would have a new sustained level of high growth.

- Step function: COVID established a “new normal” for tech demand, a step function above pre-pandemic levels. Old growth rates would continue post-COVID, just from a higher base established in 2020. This was a popular view among VCs and tech pundits.

- Mean-reversion: Acceleration through 2020 and 2021 was an aberration, and tech market growth will revert to the pre-COVID growth trendline....

Mean-reversion seemed to be the least popular story to tell—who wants to rain on the tech parade? But the last six months clarified that much of the tech acceleration was transient.

It’s a long piece, and mostly written from the perspective of the tech investor, but there’s a lot here if you’re interested in the prospects for the tech sector even if you’re not an investor.

There’s a helpful chart of two-year stock prices as well. That big red spike is Zoom, while the light blue outlier is Peleton.

(Source: Google Finance)

j2t#315

If you are enjoying Just Two Things, please do send it on to a friend or colleague.