12 July 2023. Cars | Chips

Electric cars are vastly more efficient than petrol cars. // Understanding America’s ‘chip war’ with China

Welcome to Just Two Things, which I try to publish three days a week. Some links may also appear on my blog from time to time. Links to the main articles are in cross-heads as well as the story. A reminder that if you don’t see Just Two Things in your inbox, it might have been routed to your spam filter. Comments are open.

Apologies, but the publication schedule is going to be erratic for another two weeks. I have a lot on at the moment.

1: Electric cars are vastly more efficient. It makes a huge difference to transition.

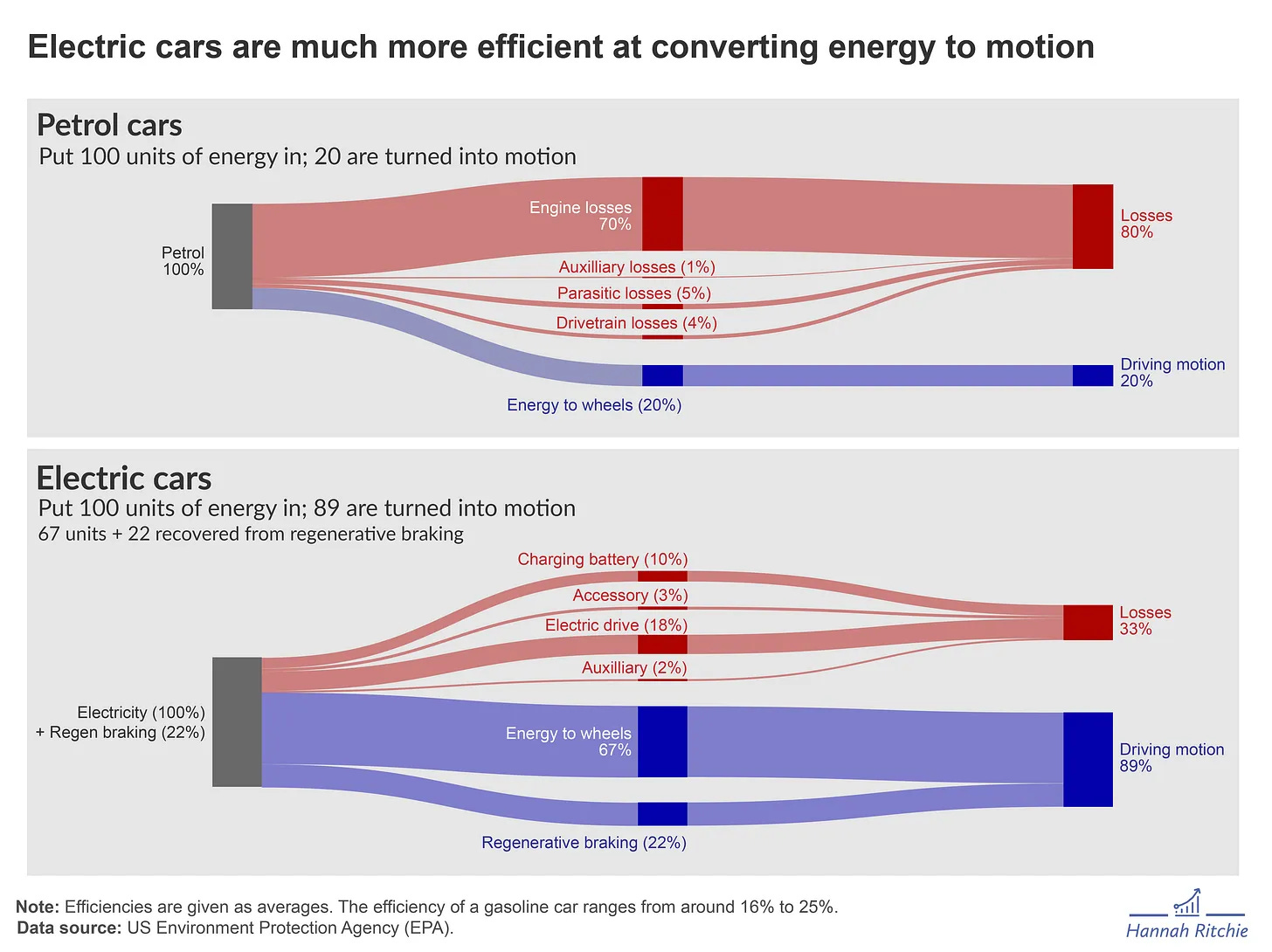

Hannah Ritchie’s excellent newsletter Sustainability by Numbers has a useful guide to the transition to electric cars. It comes down to the efficiency of energy conversion. If you put 100 units of energy into a petrol driven car, you get 20 units of motion out. If you out 100 units of energy into an electric car, you get 89 units of motion out.

(Source: Hannah Ritchie, Sustainability by Numbers)

Most of the energy in a petrol-driven car is lost in heat, and a little in noise. (Both covered as ‘engine losses’ in the chart above). One of the reasons that the electric car is so much more efficient is that it also recovers around half of the energy lost in the conversion to motion through regenerative braking.

Her source for this data is the US Environmental Protection Agency. These are averages of course, but the range between different vehicles isn’t that wide. Diesel cars are a bit more efficient than petrol vehicles, but not that much. The TL:DR version of this is that most of the energy that goes into a petrol car is wasted, and most of the energy that goes into an electric car is not.

Obviously this matters for consumers: they’re paying less for their energy, assuming that energy prices are comparable to fossil fuels. (I’ll come back to that later).

But it matters a lot more for the energy transition. I recall some of the starker forecasts a few years ago when people would argue that the transition would fail because we would wouldn’t be able to generate enough energy, especially for the transport fleet. Those analysts were probably assuming that the efficiency of electric cars was similar to petrol cars. As Hannah Ritchie comments:

With a switch to electric vehicles, we get rid of most of the ‘wasted’ energy. That means we need to produce much less electricity. Let’s take an example. Say a country burned the equivalent of 1,000 terawatt-hours (TWh) of gasoline for road transport [all of these numbers are hypothetical]. You might imagine that we’d need to produce 1,000 TWh of low-carbon electricity to replace gasoline cars with electric ones. But that’s not true. You might need as little as 224 TWh of low-carbon electricity. Four to five times less.

She does the sums in a footnote, but what the footnote does is to spell this out: that for the purposes of transition, you need to focus on the ‘useful’ energy in the current transport system—meaning the energy that’s actually used to propel the vehicles forward, and then calculate how much energy you need to generate the same ‘useful’ energy.

(So: the ‘useful’ energy in the example above is 200 TWh—and to get 200 TWh of useful energy in an electric system, with 89% efficiency, you need to generate 100/89 x 200 TWh—hence 224 TWh. The other part of this story is the efficiency of the power generation system—renewables are more efficient than producing electricity from gas or coal.)

Of course, the story is a bit more complicated than that. We probably don’t want to replicate the same quantity of vehicle-miles in the future if we can avoid it, because electric cars still have a resource cost, and also still generate forms of pollution. Notably, notably you still get small and unpleasant particles of pollution from tyres and brake pads.

Cars also contribute to significant forms of social inequity, in terms of relative access of those who have cars against those who don’t. And they have a massive land take, which is usually free or subsidised, which we have completely internalised.

The other complexity here is the significant risk that these much cheaper energy costs increase demand for driving. (This is the well-known ‘Jevons paradox’, named for the 19th century economist who noticed that as the cost of coal fell, coal was more widely used, and demand rose. Efficiency gains don’t always translate into lower resource use.

This may sort itself out, however. One of the other effects of the transition to electric vehicles is that government tax take on fuel also falls. Since electricity is widely used for other things (essentials such as heating and lighting), simply taxing electricity doesn’t work well.

So, somewhere in the transition we’re either going to see an increase in the tax on cars, or a tax on mileage. Taxing cars is easier at the moment. But that is changing as technology improves.

2: Understanding America’s ‘chip war’ with China

I’ve managed not to write here about the ‘chips’ wars that seem to be at the heart of the stand-off between the United States and China at the moment. I’d see pieces, but they were pieces—it was hard to get a good overview.

So an extended email interview by Noah Smith with Chris Miller, author of last year’s Chip War, generally regarded as the best book on the subject, and not paywalled, seems like a good opportunity to make good on this.

It’s a long interview, with a lot of detail, so I’ll just try to pick out some of the main observations here. Smith’s first question was about his surprise that the US had, by imposing export controls on China’s high-end chip industry, “basically declared economic war” on China, as a way, it seemed, to deter China from attacking Taiwan:

CM: (T)he U.S. government is very concerned about Chinese intentions over Taiwan over the next decade. There are only a limited number of tools the U.S. has to influence Chinese military and intelligence capabilities over a 5-10 year time horizon, but trying to slow China's chip industry and its compute capabilities are one plausible way to do it... Second, China has been catching up in certain parts of the chip industry. The picture is mixed, but certain segments (eg YMTC, a memory chip firm) were making impressive strides while using tools imported from the U.S. and allies. So it wasn't plausible to claim that, assuming the status quo persisted, China wouldn’t keep making progress. Third, the argument for waiting -- for using the threat of export controls as a deterrent -- didn't seem compelling, especially given the failure of U.S. sanctions to deter Russia from attacking Ukraine.

One of the arguments against economic controls on chips and the related machinery is that China was dependent on American imports, and so forcing it to reduce its dependence will merely accelerate China’s rate of innovation. Miller is not persuaded by this: China had already demonstrated that it was busy reducing its dependence on Western chips and tools. And it was doing that precisely because it realised howdependent it was on them.

But: filling the gap is hard to do. You can’t buy a lithography machine without people noticing:

The likelihood of purchasing these machines through third countries is close to zero. The number of advanced tools produced each year measures in the dozens, and there are only a handful of customers. A single advanced lithography machine requires multiple airplanes to transport.

(Source: AMSL)

The critical player here is ASML, the Dutch business that makes the lithography machines that lets its customers make top-end chips. If you can’t buy a machine, could you build your own?

It took ASML three decades to develop EUV (extreme ultraviolet) lithography tools, and it was only possible in close collaboration with users like TSMC and Intel... (T)hese are the most complex and precise pieces of equipment humans have ever made. The challenge isn't only to replicate the unique components inside the tools – such as the smoothest mirrors humans have ever made – though this will be hard. The really challenging part will be to get the hundreds of thousands of components to work often enough so that the tools can actually function in high-volume manufacturing.

This involves precision manufacturing at the nanometer scale. Lithography is the toughest part of all of this, but there is also a whole bunch of other processes that are needed and which are also complex—“deposition tools, etching tools, metrology tools”—and China is also behind on all of these.

There’s quite a lot of discussion in the piece of President Biden’s attempts to build up the US chip fabrication (‘fab’) industry, and some of this is probably only of interest to policy wonks with a close interest in what happens inside the Beltway. So I’ll skip most of that here.

But some of it is relevant to the challenges of maintaining a developing a leading edge technology sector anywhere.

First, capital investment involved is huge (in this case, the billions of dollars), so things like tax policy and depreciation schedules make an enormous difference to viability.

Construction costs are higher in the US, and (to my surprise) the regulatory and permit regime in the US means that it takes longer to build a ‘fab’ plant in the US than it does in Europe, not known for light-touch regulation.

And the ecosystem is a critical success factor:

There's a lot of niche know-how involved in building fabs. The Taiwanese and Koreans have built a lot of fabs recently, so they've honed this know-how, both at chip companies but also at the large network of suppliers they rely on. As fab construction in the U.S. slowed in recent years, some of this expertise deteriorated.

If you’re going to have an industrial strategy, in other words, you need to keep at it. Smith asks one of those economists’ questions about whether it would be better to back innovators with different approaches to the market than build vastly expensive fab plants. To be fair, he is thinking of the way in which nVidia side-stepped competition by developing GPUs (general processor units) for AIs, and before that, similarly, Intel developed microprocessors.

Miller’s reply is stark:

I think we need both. The current level of geographic concentration in chip fabrication and assembly is dangerous, and no number of startups can address this in the short run. If a crisis breaks out in East Asia, we'll look like Germany and Nord Stream, but ten times as naive because the economic impact will be vastly worse.

But I agree that in the longer run, the chip industry will be defined by its most innovative firms, so trying to help incumbents isn't a great long-run strategy... We're better off using R&D funds to facilitate startup formation, e.g. by giving startups access to expensive tools that they otherwise wouldn't be able to afford.

Skills also matter—home grown and imported. But, he says, importing them from particular places is also a form of geopolitical competition:

(I)f you're really interested in strategic competition with China, a visa program specifically targeted at semiconductor workers from China would be a win. America's ability to strip its adversaries (USSR, Iran, China etc) of their brightest minds has been key to its geopolitical success.

j2t#476

If you are enjoying Just Two Things, please do send it on to a friend or colleague.